RISK INDEXES from Global Risk Profile

Assess Corruption & ESG risks efficiently

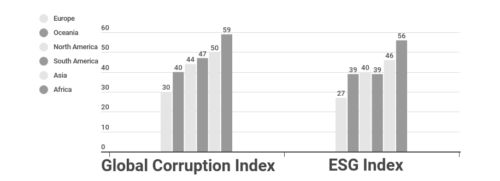

GLOBAL CORRUPTION INDEX

The Global Corruption Index (GCI) is a unique tool measuring country exposure to public and private corruption as well as to other white collar crimes, such as money laundering and terrorism financing. The GCI is based on robust objective and subjective indicators provided by internationally recognized entities. Built as a composite index, it comprises two complementary sub-indexes (corruption & white collar crimes), allowing both for a more nuanced and integrated perspective.

The Global Corruption Index provides an independent score, ranking and risk evaluation for as many as 196 countries, offering a compliance solution to current legal frameworks such as the FCPA, the UK Bribery Act and the French law Sapin II.

ESG INDEX

With its global coverage of 179 countries, the ESG Index or ESGI (Environmental, Social and Governance Index) assesses risks concerning the environment, human rights and health & safety on a country level.

Based on international references such as the Universal Declaration of Human Rights, the UN Global Compact, the 8 ILO fundamental conventions and the UN Conference on Environment and Development, it combines three unique sub-indexes for a global and a per-domain perspective.

The ESG Index can be used to comply with corporate social responsibility & ESG legislations such as the Corporate Duty of Vigilance in France, the German Supply Due Diligence Law, and the UK Modern Slavery Act.

How you will benefit

Clear, reliable and accurate : our risks indexes are market oriented tools aiming to help decision makers deal with an overwhelming amount of data of variable quality. Benefit from a robust methodology and a maximal coverage to safely compare country results for a sound risk evaluation. You can easily integrate our indexes into your compliance and decision-making processes, as well as a part of your reporting obligations.

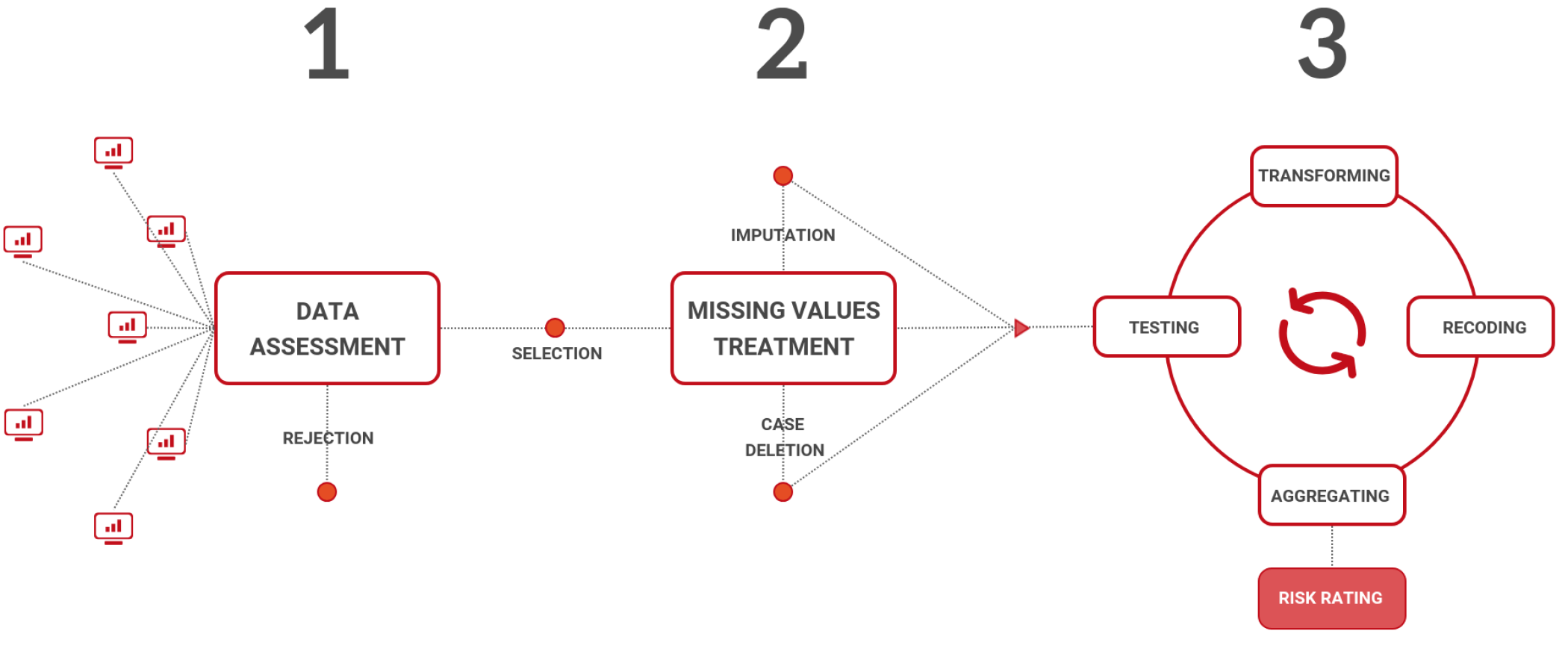

Methodology

Global Risk Profile indexes are computed following a process-driven and iterative methodology. Data is first assessed in terms of quality, coverage and reliability. Missing values are then evaluated on a case-by-case basis, in order to determine if an imputation procedure is acceptable or to dismiss. A global cyclical back-and-forth testing process ensures the quality of the risk evaluation.

Membership Solutions

We offer three different types of membership solutions. A basic account is always free. With a standard account, get access to more data analytics, infographics and country risk profiles. Opt for a premium account if you are looking for analysis of ESG regulations by country and / or if you are interested in our semi-automated screening reports.

Basic Account

CHF

0

Always Free

-

Adapted for: discovering the indexes

-

Adapted for: Adapted for: Academics & Professionals

Standard Account

CHF59

CHF

39

per month-

Adapted for: Academics & Professionals

-

Adapted for: Adapted for: Academics & Professionals

Premium Account

CHF

149

per month

-

Adapted for: ESG and Compliance officers

-

Adapted for: Adapted for: Academics & Professionals

The increasing need for Objective Risk Indexes

It is increasingly challenging for companies & other entities to efficiently address third-party risks (fraud, corruption, money laundering, and now ESG related risks) while applying regulatory compliance.

Bearing this complexity in mind, we at Global Risk Profile, leveraging our knowledge as compliance experts, have built two unique indexes – the Global Corruption Index & the ESG Index. These professional tools bring together various dimensions to significantly facilitate compliance processes. They allow for efficient risk mapping, the starting point of a sound and robust risk assessment.

The corporate world faces an increasing number of local and international laws, imposing thorough Due Diligence verifications. Corruption, fraud and money laundering issues are in the spotlight like never before.

France recently introduced the law No. 2016-1691 concerning transparency & the fight against corruption (known as law Sapin II). The European Union is adopting successive anti-money laundering directives, the latest being the 6th AML Directive currently under discussion. These new rules supplement those already in place such as the UK Bribery Act and, on a more global level, the Foreign Corrupt Practice Act (FCPA).

In parallel, a new regulatory trend is spreading across Europe: countries such as Sweden, Germany and France have set up ESG legislations in an effort to prevent major environmental and social violations. Growing concern has led France to pioneer the adoption of the law “Devoir de vigilance des sociétés mères et entreprises donneuses d’ordre” in 2017.

10 December 2021

0

Nordic countries at the top of the 2021 ESG Index

Geneva, December 10, 2021 - In a context where environmental and human rights issues are

3 November 2021

0

The 4th edition of the Global Corruption Index (GCI) includes new measures of white collar crimes

Geneva, November 03, 2021 - Global Risk Profile (GRP) releases the 2021 Global Corruption Index (GCI).